MArch 1, 2023

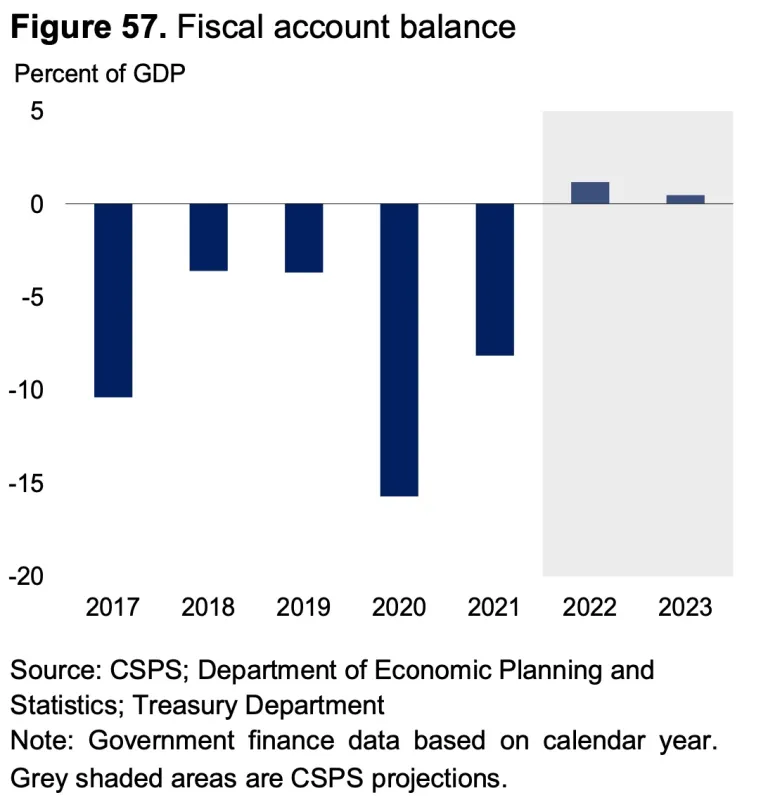

Brunei is on course to record a budget surplus for the first time in seven years despite increased government spending, the Centre for Strategic and Policy Studies (CSPS) said in its latest economic outlook report.

Higher oil and gas revenue has contributed to an estimated surplus of 1.2 percent of gross domestic product in 2022 from a deficit of 8.2 percent of GDP in the previous year, the think tank said.

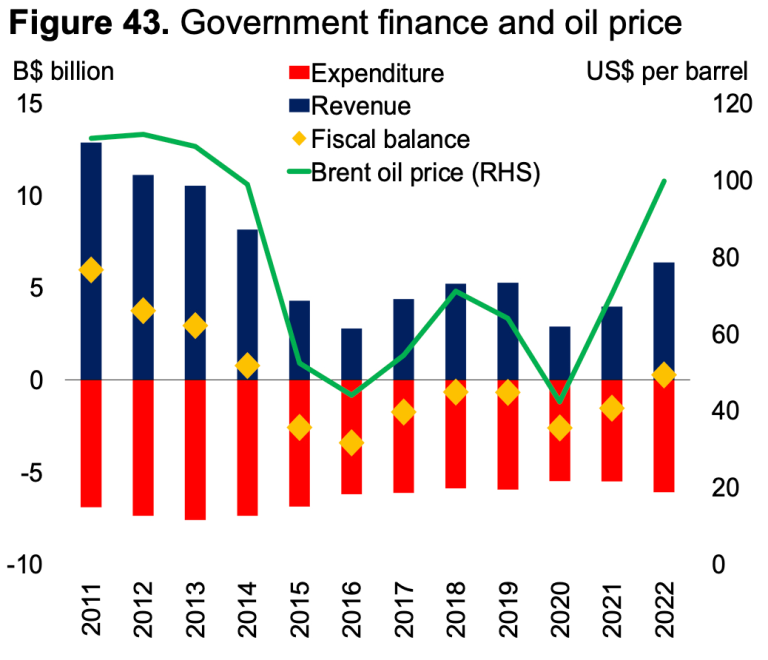

Oil and gas earnings in 2022 were 75 percent higher than a year ago as oil prices averaged US$100 per barrel as opposed to US$70 per barrel in 2021, while LNG prices were twice higher at US$18.3 per mmbtu.

The fiscal surplus defied expectations as the sultanate was projected to endure another deficit for the fourth straight financial year.

With energy prices forecast to fall but remain high, CSPS said the fiscal balance is projected to continue registering a small surplus at 0.5 percent of GDP in 2023.

Oil and gas output is also expected to increase slightly following production issues over the past year.

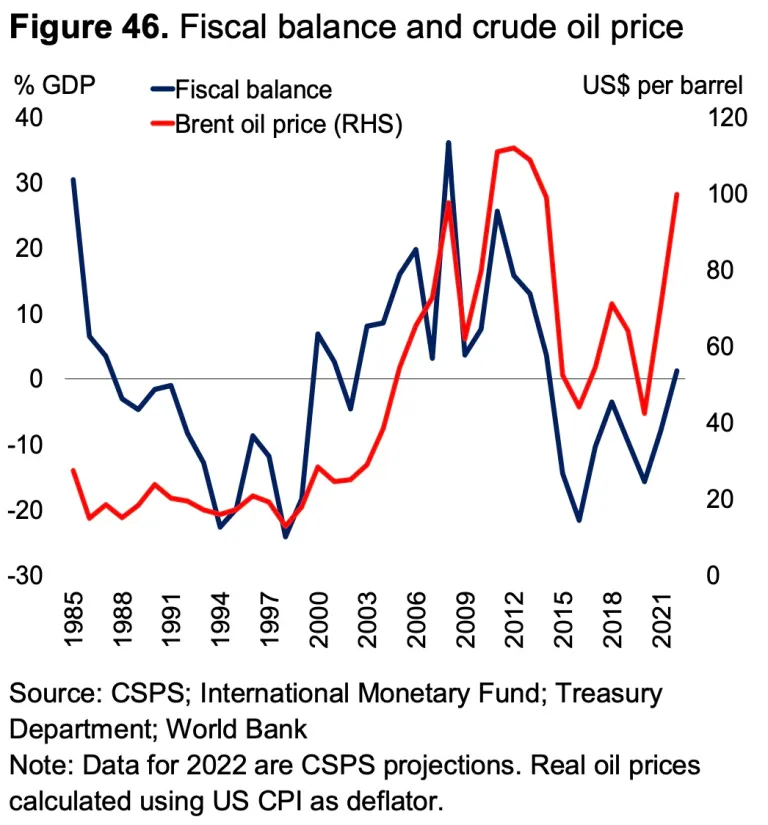

The centre said changes in Brunei’s fiscal position broadly mirror fluctuations in oil and gas prices, given the high reliance on revenue from the oil and gas sector.

Non-oil and gas earnings are also forecast to rise as economic activity in the non-oil and gas sector resumes its pre-pandemic growth trend.

In particular, the downstream oil and gas sector – categorised under the non-oil and gas sector – is predicted to lead Brunei’s economic recovery after seven consecutive quarters of contraction.

CSPS said budget deficits over the past seven years had been financed by fiscal reserves rather than through external borrowing.

“This has been possible as the government has prudently saved a fraction of oil windfalls, especially during the oil price boom in the 2000s.

“Cumulated fiscal balances reached a peak of around B$57 billion in 2014 but have declined following the oil price plunge in 2014-15,” it added.

Nevertheless, the centre said the recent financial windfall from high energy prices may not be sustainable and the revenue base must be broadened beyond oil and gas.

Government spending to continue downward trend

The think tank said government expenses as a share of GDP is expected to continue to trend lower as fiscal consolidation efforts resume.

Government spending is projected to be “somewhat contained” in 2023 as the government’s policy intention is to maintain a prudent level of spending under the Fiscal Consolidation Programme, CSPS said.

“Fiscal support measures introduced during the pandemic have been rolled back, in tandem with the transition to the endemic phase.

“Total expenditure as a share of GDP in 2023 is projected to be 28.7 percent, in line with the downward trend of government spending since 2014,” it added.

The Legislative Council had passed a $5.7 billion budget in the current 2022/23 fiscal year, a 2.7 percent cut from the previous year.

However, CSPS said current and capital spending increased last year.

“The public wage bill remains high at more than 30 percent of government expenditure and more than 10 percent of GDP,” it said.

Wage growth in the public sector has largely been stagnant since 2015.

In terms of fiscal policy, CSPS recommended financial support for vulnerable groups to address cost of living pressure in the near term, while fiscal sustainability should be prioritised in the medium term.

“Immediate tax actions can include raising or introducing excises on products with a negative health or environment impact. This would be more feasible compared to other tax options.

“Enhancing spending efficiency should also be continued, which may include containing the high public wage bill, improving the targeting of social spending, and reviewing policies on blanket subsidies to make them more targeted,” the centre added.