february 28, 2023

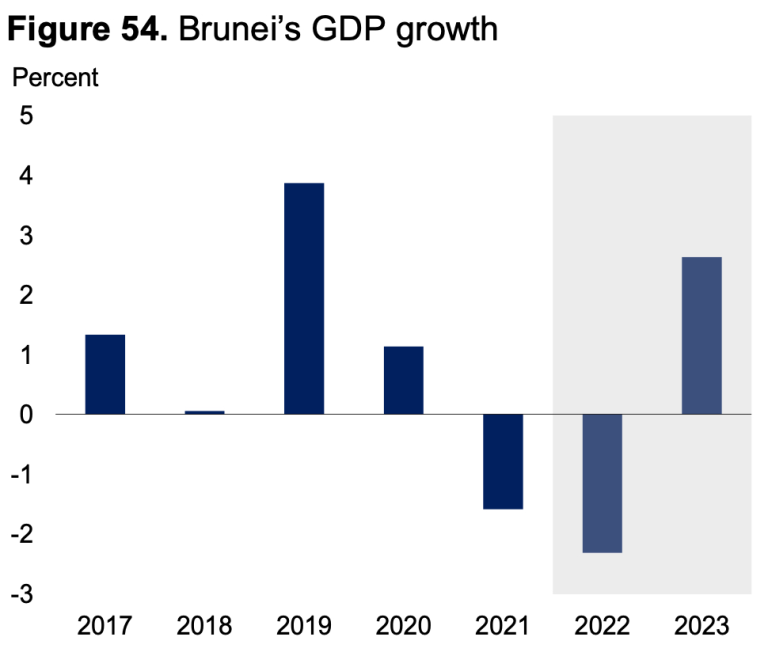

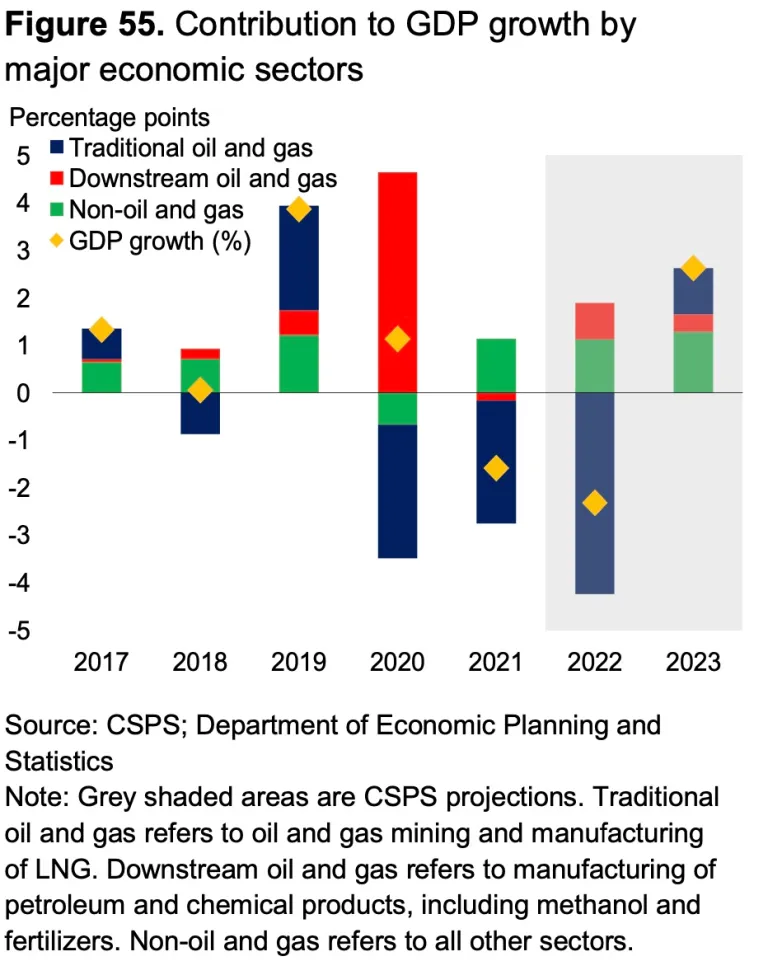

The Brunei economy is projected to end its prolonged downturn and post a 2.6% growth this year owing to better prospects in various sectors, according to the Centre for Strategic and Policy Studies (CSPS).

In its Brunei Economic Outlook 2023 publication, the think tank said the improved outlook reflects broad-based growth across sectors following seven consecutive quarters of contraction.

Real gross domestic product was estimated to have shrunk 2.3% in 2022 – the worst economic performance since 2016 as the sultanate failed to live up to expectations of a modest recovery due to persistent oil and gas production issues.

While most economic activities are expected to normalise this year with the lifting of pandemic-related measures, CSPS said real GDP would still be lower than its 2019 level.

“The projected growth rate in 2023 partly reflects base effects, as real GDP has been lower than anticipated in the past three years due to the pandemic and oil and gas sector weakness,” it added.

CSPS said the baseline projections are subject to considerable uncertainty and could be derailed by factors such as persistent inflation and further monetary policy tightening, oil market uncertainty, and protracted domestic oil and gas supply disruptions.

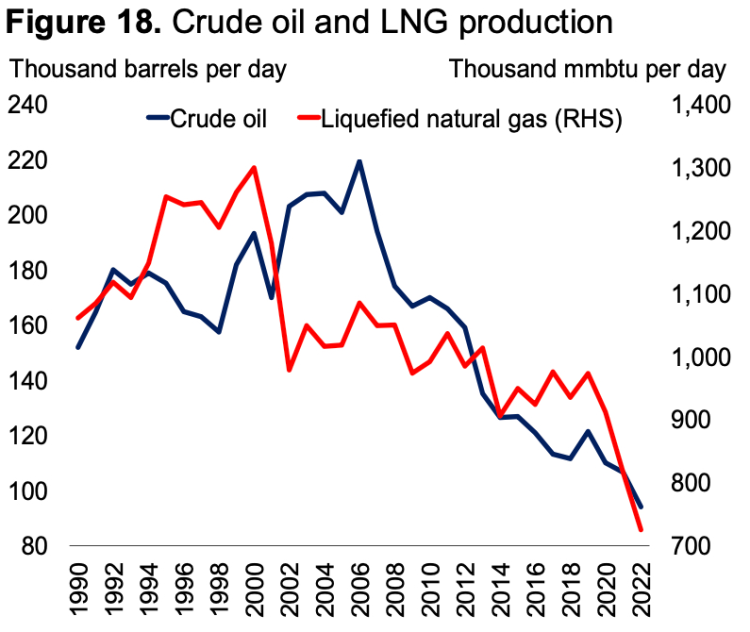

Crude oil and liquefied natural gas (LNG) production fell nearly 13% in the first three quarters of 2022.

The government previously said record-low oil output of 94,500 barrels a day in the second quarter of 2022 was a result of “unscheduled maintenance and rejuvenation activities”.

“Although the ongoing rejuvenation activities have had an adverse impact on growth, greater asset reliability would help to improve production,” the think tank said.

The oil and gas sector is forecast to bounce back from an estimated 8.2% contraction in 2022 to register a 2% growth this year.

“Growth is expected to be supported by a marginal increase in supply following asset rejuvenation activities, with crude oil production forecast at 94 tb/d and LNG production at 738 thousand mmbtu/d.”

However, unexpected disruptions to domestic oil and gas production and volatile oil prices continue to be major downside risks to the Brunei economy.

“Uncertainty in the oil market could be detrimental to the fiscal sustainability of oil- exporting countries.

“A sharp decline in global oil demand and prices will directly affect Brunei’s exports and government revenue, with spillovers to other sectors of the economy,” CSPS added.

The volatile price environment further poses risks to the commercial viability of new offshore exploration and production.

Energy prices have surged after the Russia-Ukraine war broke out last February, with Brent crude oil prices averaging US$100 per barrel in 2022 – over 40% higher than in the previous year.

Given the bleak global economic outlook in 2023, energy prices are projected to be lower than in 2022 but will still be at elevated levels.

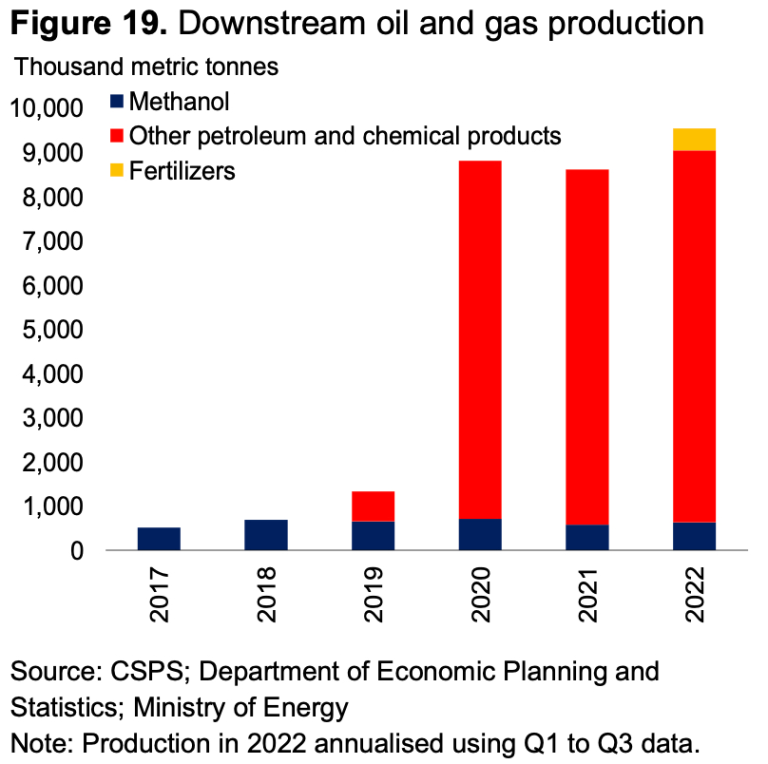

Since 2021, crude oil and LNG no longer dominate Brunei’s exports as other petrochemical products now make up the majority of exports.

“The share of crude oil and LNG in total exports has fallen sharply from 90% in 2018 to 39 percent in 2022,” the CSPS report stated.

Rosy outlook for downstream sector

CSPS added that the downstream oil and gas sector – consisting of the production of petrochemical products – is set for robust growth and will continue to be a major driver of the sultanate’s economic expansion.

The downstream sector — a key driver of growth since 2020 — is predicted to grow 5.4% this year, after output had increased by an estimated 13% in 2022.

The think tank said methanol production rose 8.8% in the first three quarters of 2022, while production of other petroleum and chemical products grew 4.9% over the same period.

Meanwhile, the start of state-owned Brunei Fertilizer Industries’ urea production last year is expected to increase exports.

Since January 2022, over 631,000 metric tonnes of urea fertiliser have been produced, while 556,000 metric tonnes worth US$322 million were exported.

CSPS further said the expansion of Hengyi Industries’ oil refinery and petrochemical plant has been delayed, but will be a significant boost to the economy when the project is commissioned.

Services sector a bright spot in 2022

The non-oil and gas sector is forecast to grow 2.8% year, following an estimated growth of 2.6% in 2022.

The services sector contributed to the growth of the non-oil and gas sector after expanding 5.1% year on year in Q3 2022.

Growth of the services sector was attributed to the lifting of COVID-19 measures, including the reopening of international borders last August.

Brunei is expected to receive a much-needed boost in tourist arrivals with China’s reopening. China was one of Brunei’s top tourism markets before the pandemic.

International arrivals by air remain well below pre-pandemic levels, despite the air transport sub-sector soaring 250% year-on-year in Q3.

Another positive development is the growth of the fishery sector, which jumped 7.2% in the first three quarters of 2022.

However, CSPS said construction remained weak due to challenges in hiring foreign labour and a lack of new infrastructure investment. The sector’s output declined 3.8% in the first three quarters of 2022, following a contraction of 5.6% in 2021.

“Nonetheless, constraints on labour supply have begun to ease with more migrant workers returning after the lifting of border restrictions,” the centre added.

Source: https://thescoop.co/2023/02/28/economic-recovery-on-the-cards-in-2023-csps-projections/