OCTOBER 17, 2022

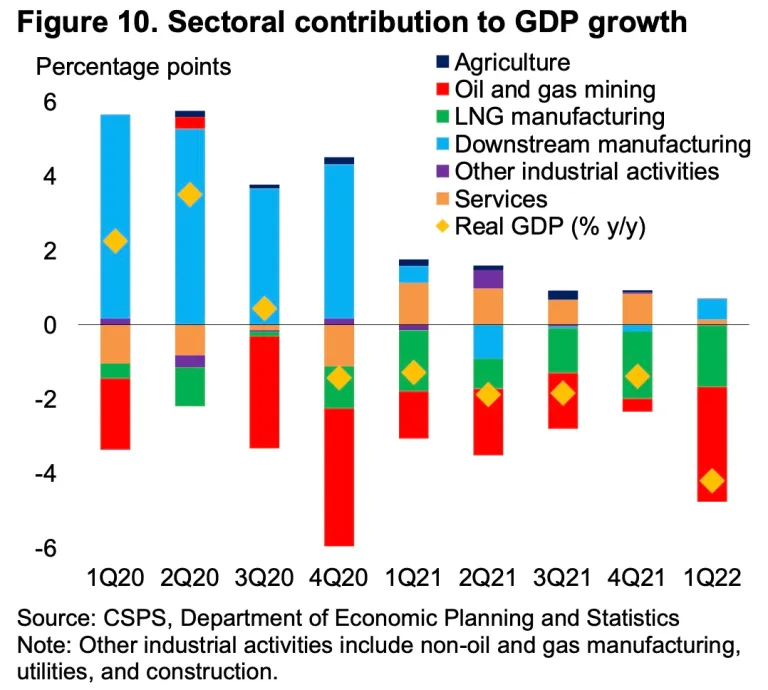

The Brunei economy is still expected to stage a modest rebound in 2022 despite a sharp contraction of 4.2 percent in the first quarter of the year, according to Centre of Strategic and Policy Studies (CSPS).

In its Brunei Economic Update August 2022 publication, the think tank said it has a “cautiously optimistic” outlook on growth, but warned of significant downside risks.

The downstream oil and gas sector will continue to drive economic growth as external demand rises, while the services sector is predicted to bounce back after full reopening of the economy.

Strong growth was reported in the manufacturing of petrochemical products in Q1 2022, and the start of Brunei Fertilizer Industries’ ammonia and urea production is forecast to increase revenue in the downstream sector.

Earlier this year, CSPS had projected that the sultanate would end its recession and record a positive growth of 3.7% in 2022.

In contrast, the International Monetary Fund last month predicted that the Brunei economy will grow at a lower rate of 1.2 percent on the back of easing public health curbs and rising energy prices.

CSPS said increased earnings in the downstream sector “should more than offset the decline in oil and gas production”.

The negative growth in Q1 2022 was attributed to steep contraction in oil and gas mining (-7.8%) and manufacturing of LNG (-12.8%).

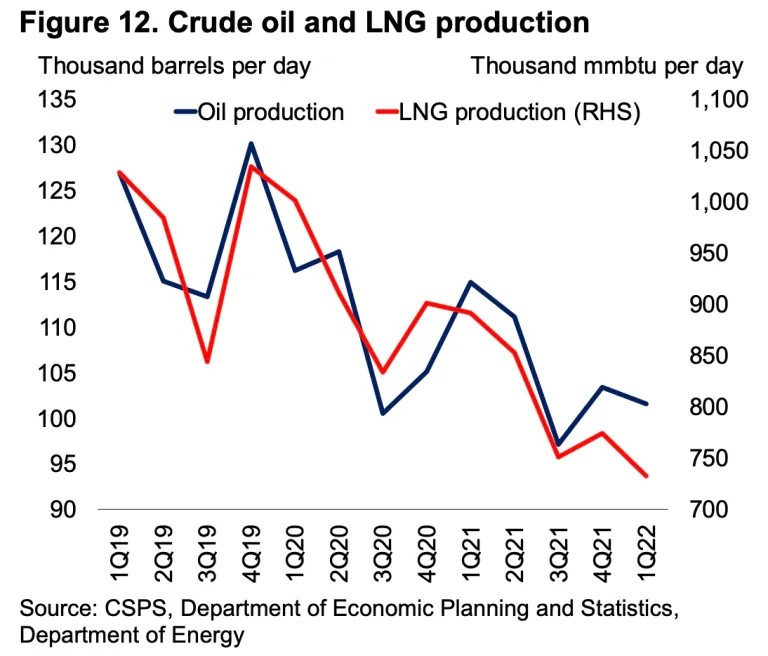

Crude oil production fell to 101,600 barrels a day from 114,900 barrels a day in the first quarter, while LNG production decreased to 732,400 million British thermal units a day (mmbtu/d) from 891,300 mmbtu/d over the same period.

The lower output follows the surge in Brent crude oil prices, topping US$100 a barrel for the first time since 2014 in February when the Russia-Ukraine war began.

Maintenance and rejuvenation activities were cited as the cause of the continuing downward slide in Brunei’s upstream oil and gas production.

The hydrocarbon sector fell 4.5 percent last year, and crude oil and natural gas no longer dominate Brunei’s exports as other petrochemical products now account for the majority of exports.

The economic contraction in Q1 meant that Brunei had been posting six consecutive quarters of negative growth amid the COVID-19 pandemic that resulted in stay-at-home restrictions and decreased economic activity.

Brunei had previously experienced such growth outcomes, when the economy shrunk for seven consecutive quarters from Q3 2013 to Q1 2015.

CSPS said two major downside risks contributed to weak growth in Q1 — the emergence of the more infectious Omicron variant and further disruptions to domestic oil and gas production.

“The emergence of more virulent and vaccine-resistant COVID-19 variants, although a tail risk, remains a threat to economic recovery.

“Unanticipated domestic oil and gas supply disruptions also present a material downside risk to the [growth] outlook,” the report added.

Elsewhere, the fisheries sector continued to expand by 15 percent in Q1, following double-digit growth rates in the preceding seven quarters.

The air transport sector is also gradually recovering as borders have reopened for non-essential travel in May, following steep contractions over the past two years due to the pandemic.

Fiscal surplus on the cards?

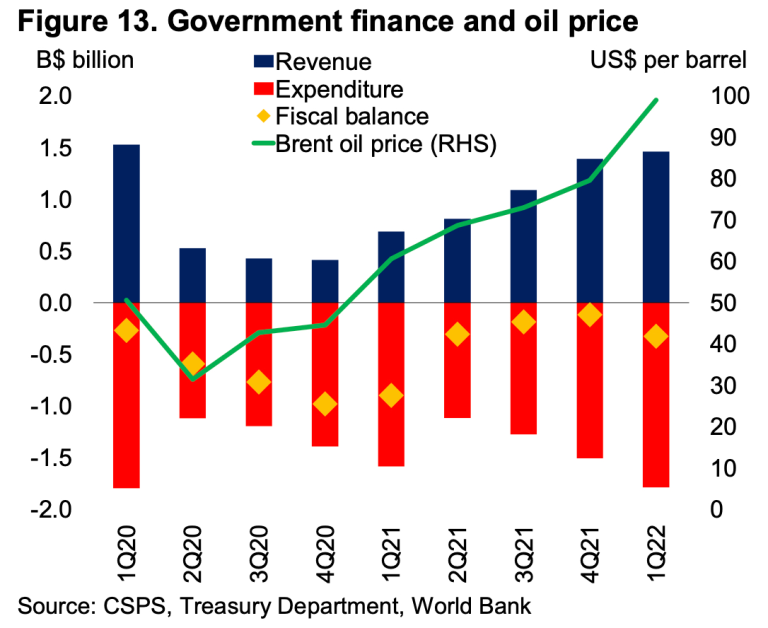

Brunei’s fiscal position is projected to see a marked improvement and may even register a small surplus if oil prices remain high, the think tank said.

“Crude oil and LNG prices have increased following a recovery in global demand in the second half of 2021, and have risen even more sharply after the war in Ukraine led to heightened concerns over supply,” it added.

In Q1 2022, Brunei’s fiscal position remained in deficit due to increased government spending, but CSPS said a fiscal balance or surplus is possible owing to elevated oil prices.

The government earlier this year had a more downbeat outlook on the easing of the budget deficit, stating that spending was expected to outpace revenue for the fourth straight financial year.

Inflation soars to 25-year high

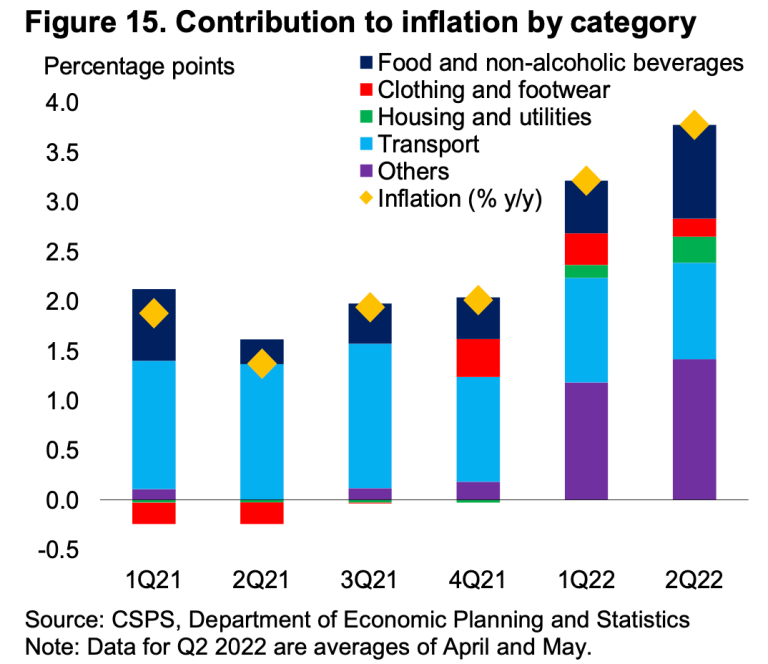

Brunei’s inflation rate surged to 3.9 percent in April, the highest in over 25 years before easing slightly to 3.8 percent in May.

Global supply chain pressures due to the war in Ukraine and extended lockdowns in major Chinese cities have pushed up prices in food products.

However, CSPS said price control and subsidies have helped to keep inflation in check, including electricity and petrol prices.

“Moreover, monetary policy tightening by the Monetary Authority of Singapore has supported a strong Singapore dollar, and hence a strong Brunei dollar owing to its currency peg, which has helped to contain imported inflation,” the think tank said.